My Choice Supplemental Needs Trusts empower individuals with disabilities to live more independently, with dignity and choice.

Individuals with disabilities who receive Medicaid and/or Supplemental Security Income (SSI) must follow strict rules about how much money or how many assets they can have in their name. Having assets over these limits can threaten their ability to keep these benefits.

My Choice Supplemental Needs Trust offers a solution. By establishing an account with us, individuals can protect their assets while keeping government assistance. At the same time, they gain the freedom to use their funds for life-enhancing expenses not covered by Medicaid or SSI—such as hobbies, travel, education, and more.

Community (Pooled) Supplemental Needs Trusts

If you meet the medical criteria for government benefits, such as NYS Medicaid or SSI, but have concerns about asset limits affecting your eligibility, a Supplemental Needs Trust can help you preserve your assets while maintaining access to these vital programs.

A Community Supplemental Needs Trust (SNT), also known as a Pooled SNT is a type of trust created to help people with disabilities.

A Pooled SNT is designed to manage funds for the benefit of a person with a disability without jeopardizing their eligibility for means-tested government benefits, such as Medicaid and Supplemental Security Income (SSI).

A Community (Pooled) Supplemental Needs Trust establishes a relationship among three parties:

- Donor/ Granter – who funds the trust

- Beneficiary – who the trust benefits

- Trustee – non-profit organization who administers the trust and manages the funds (CCANY)

Trust Overview

A Few Highlights of our Community Supplemental Needs Trust

Community Trust I offers immediate and long-term support by helping a person with a disability pay for life-enhancing activities that their government benefits do not provide while allowing them to maintain their eligibility.

Community Trust I can be established by the individual, a parent, grandparent, legal guardian, power of attorney, or a court order. There are no age requirements or limitations.

How a Community Supplemental Needs Trust Works:

- Managed by non-profit organizations, with a financial institution as co-trustee.

- While each person has their own account, these accounts, often referred to as sub-accounts, are “pooled” for managing and investment purposes.

- The pooled management of accounts enables highly skilled trustees to combine and manage resources cost-effectively, resulting in lower costs to the beneficiaries.

- When many sub-accounts are managed together, trustees have access to a wider array of investment opportunities, including greater diversification, which can reduce risk.

- Documents already drafted and approved by Medicaid and SSA.

- Protect assets from government benefit limits so they can be used as needed for items not covered by Medicaid.

- Accounts are managed by professionals who understand special needs planning, follow the changing benefit rules and who are knowledgeable about local services.

- If an individual with a disability has no living parent or grandparent, the opportunity to utilize a pooled trust instead of working with the courts may be preferable.

- There are no age limitations.

My Choice Community Trust I

In addition, My Choice Community Trust offers

- Minimum funding to open an account is only $250.

- Once the Joinder Agreement (enrollment application) is completed in full, notarized, and submitted, the enrollment process typically takes approximately 1 week.

- Available throughout NY State

- Anyone in NY State with a qualifying disability (per Medicaid or SSA) can apply, regardless of connection to any provider agencies or organizations.

Community Trust I is best suited for individuals in New York who receive government benefits, such as SSI and/or Medicaid, and need to protect excess resources (assets) or an unexpected sum of money, such as proceeds from an inheritance, settlement, retroactive Social Security award, or other resources.

To participate in a Community SNT, the beneficiary must have a qualifying disability as defined by Social Security and Medicaid.

If the beneficiary is not yet receiving government benefits like SSDI, SSI or Medicaid based on disability, they may need to request disability determination through Medicaid. They do not need to receive government benefits to participate in the trust.

To learn more about Medicaid and SSI Resource Limits, please visit the Resources Section below.

*NOTE Any funds remaining in the account after the passing of the beneficiary will be retained by the trust for the sole purpose of supporting other individuals with disabilities.

| Medicaid Resource Limits 2025 | Monthly Income |

Assets |

|---|---|---|

| Individual | <$1,800 | <$32,396 |

| Married Both Applying | <$2,433 | <$43,781 |

| Married One Applying (Applicant) | <$1,800 | <$32,396 |

| Married One Applying (Non-Applicant) |

<$3,948 | <$157,920 |

| SSI Resource Limits 2025 | Monthly Income |

Assets |

|---|---|---|

| Individual | <$1,971 | <$2,000 |

| Married – Combined | <$2,915 | <$3,000 |

*SSI does not factor separate limits or benefits for married couples

“Asset Limits” do not include IRAs or 401Ks that are in payout status, your home and the land that is on (as long as you live there or will be returning there), one vehicle per household, household items, personal belongings, a burial fund up to $1,500 or a life insurance policy with a cash value up to $1,500.00, non-refundable pre-paid funeral arrangements, unlimited term life insurance and whole life insurance with a face value of $1,500.00 or less.

Sheltering additional funds in a trust means the freedom and independence to vacation, enjoy entertainment and other recreational activities that benefits do not cover, and now qualify for the Medicare Savings Program (at least $185 monthly).

*For information on eligibility and qualifications for NYS Medicaid please visit New York State Department of Health or the Office for People with Developmental Disabilities (OPWDD).

*For Supplemental Security Income qualifications, please see SSA.gov.

*For information on Supports and Services available to people with intellectual and/or developmental disabilities in NYS, please visit the Knowledge Center.

About Us

My Choice Trust

My Choice Trust is sponsored by Coordinated Care Alliance NY (CCANY), a

Management Service Organization born out of the collaboration of two NY State 501(c)3 non-profit Care Coordination Organizations – ACANY and LIFEPlan CCO.

Together, these Care Coordination Organizations, also known as CCOs, provide responsive, high-quality Care Management Services and support for more than 50,000 individuals with intellectual and/or other developmental disabilities throughout 48 counties in NY State.

*You do not need to be a member of a CCO to apply for or open an account with

My Choice Trust.

The Mission of My Choice Trust

Our mission is to protect and provide resources to assist people with intellectual and other developmental disabilities in living their most healthy and meaningful lives, by safeguarding their assets for personal use and enjoyment, enabling them to qualify for and maintain eligibility for “means-tested”* government benefits.

*Means-tested benefits are benefits that impose an asset or income cap to qualify.

As a mission-forward organization, we will continuously strive to provide innovative programs and resources in efforts to assist individuals and families in achieving their goals, flourish as members in their communities, and live their most meaningful lives.

Person with a qualifying disability wishes to apply for or maintain government benefits, like SSI or NYS Medicaid.

Government benefits fund shelter, medical and dental care, assistive devices, programs and more.

To qualify for and maintain eligibility for these benefits, one must not exceed strict asset limits.

A person can protect assets above benefit limits in order to qualify for or maintain these benefits.

Money from the SNT (disbursements or withdrawals) can be requested for the sole benefit of the beneficiary to supplement items that benefits do not cover.

Where To Begin

Establishing an SNT Account

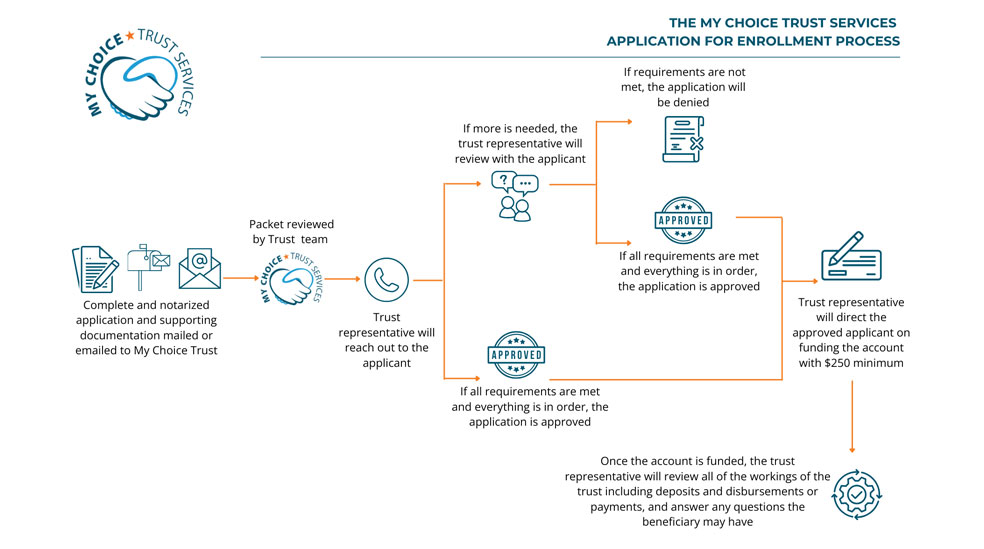

Establishing an account for the My Choice Trust can be completed in a few simple steps outlined below! Video tutorials and an in-depth flowchart of the process can be found at the bottom of this section.

Joinder Agreement (Enrollment Application)

- Complete the Joinder Agreement in full, sign, date and have notarized. This is the primary document needed to apply for the Community Trust I.

- If signed by Guardian or Power of Attorney (POA), a copy of the legal document granting authority must be included.

Supporting Documentation

Please include the following documentation:

- Copy of your (Beneficiary’s) Social Security Card

- Copy of SSA Award Letter, or SSI 1099, if you are receiving SSI or SSDI.

- If you are not yet receiving Medicaid or SSI at time of application submission, include documentation of a disability determination through the Social Security Administration.

- Copies of any guardianship or POA paperwork.

- If the account creation is due to a court order, submit a copy of the order.

Mail or Email the Packet

Submit the Joinder (Enrollment Application) along with all supporting documentation r by mail or email:

Mail: My Choice Trust Services 258 Genesee St. Mezzanine Level, Utica, NY 13502

Email: intake@mychoicetrust.org

What to Expect After Applying

Once we receive the packet, the Director of Trust Services will review and reach out to the applicant for any additional steps.

If approved, the applicant will be contacted to discuss steps in funding the account.

Feel free to contact us with any questions concerning the trust or our processes!

Brief tutorial videos and flowchart for the SNT process

Withdrawals and Payments

Funds sheltered in supplemental needs community trusts are intended to supplement the supports and services covered by NY State Medicaid, SSI, or other means-tested government programs. They are intended to enhance the life of the beneficiary and therefore, withdrawals and payments, also known as disbursements, should be requested for direct payment to third parties for items not otherwise covered by government benefits. All withdrawal requests will be reviewed on an individual basis. Approval is at the discretion of the trustees.

Requests must meet the guidelines below:

Once all of the above items are in order:

MAIL: Download, print, and mail the completed form with the supporting invoice and/or documentation to:

My Choice Trust – 258 Genesee Street, Mezzanine Level Utica, NY 13502

EMAIL: Download the completed and saved form and email this form, along with the supporting invoice(s) and/or documentation to: Request@MyChoiceTrust.org

FAQ’s

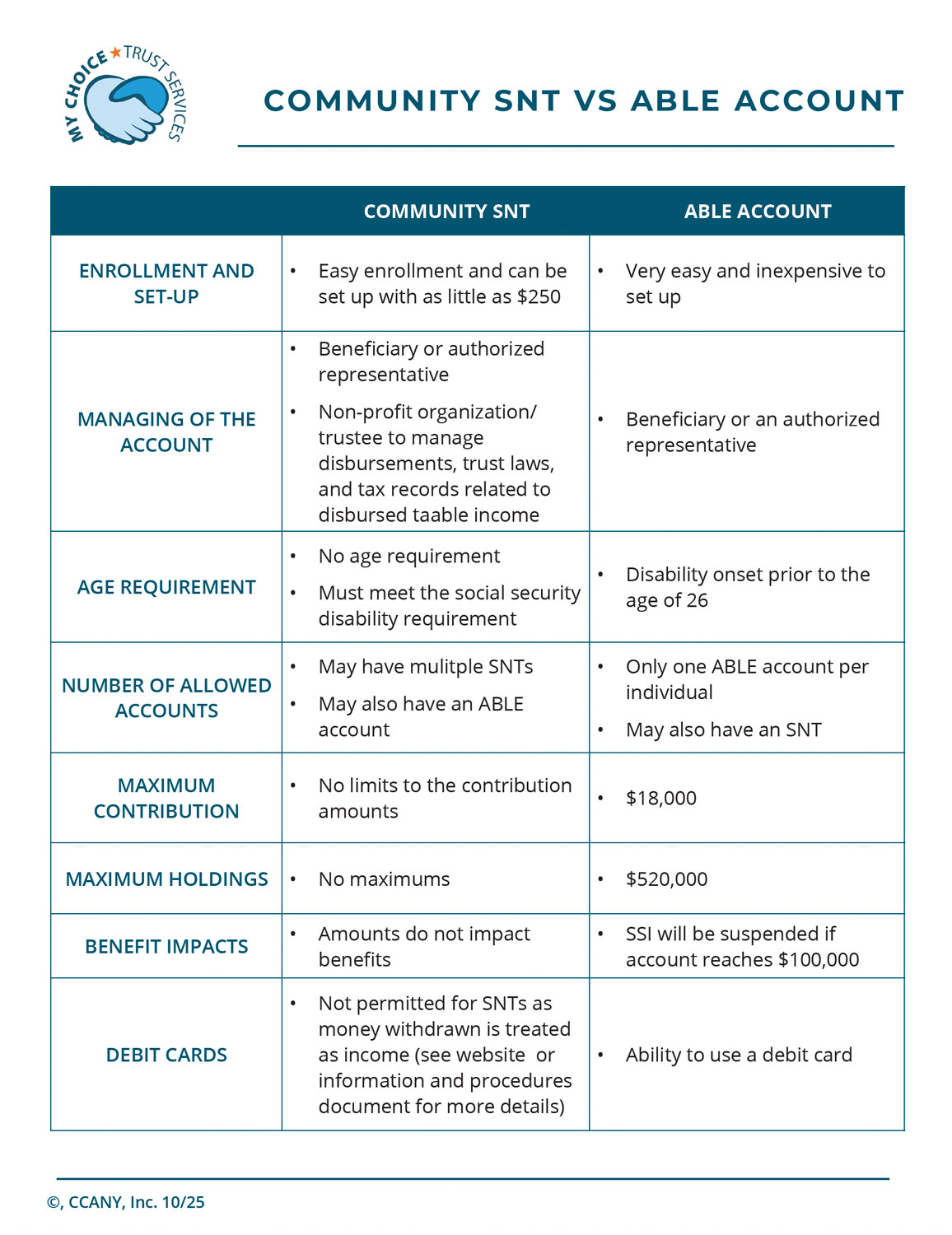

Community SNTs vs ABLE Accounts

ABLE Accounts and Community SNTs both offer a way to safeguard resources and preserve financial eligibility for benefits. Each offer unique advantages.

You don’t have to choose one over the other—ABLE Accounts and Community SNTs can be used simultaneously to maximize the resources available and enhance financial flexibility.

To help you compare these options, we’ve included a downloadable chart outlining the key differences and benefits of each.

Helpful Resource Links

Document Library

Please click the tiles below to download the document. Once downloaded, you can either fill in electronically and save with a new name to your hard drive or print the document to complete by hand in hard copy. Documents requiring signatures and notarization will need to be printed, signed and notarized. From there, you can either scan and upload for electronic submission or mail in the hard copy.

CLICK TO OPEN

Contact Us

Representatives are available to speak with you Monday through Friday, 8:30 am – 4:30 pm.

If we are not able to take your call, please leave a message and we will return your call as soon as possible.

You can also reach us by email at the address below.

We look forward to hearing from you.